Funds are funds, but you also need to understand them. While they do a great job of researching projects and supporting them, the strategy of blindly following their investments is not safe. Each venture company can raise funds with a specific strategy that you don't know about. And some are just flippers.

In addition, they all have different reputations, experts, networks, tools, and influences. And even if you saw a project in the portfolio of a tier-1 fund, this does not mean that it will 100% fly. Venture investments are among the most risky even for such large VCs and even despite the cleverly worded term sheets.

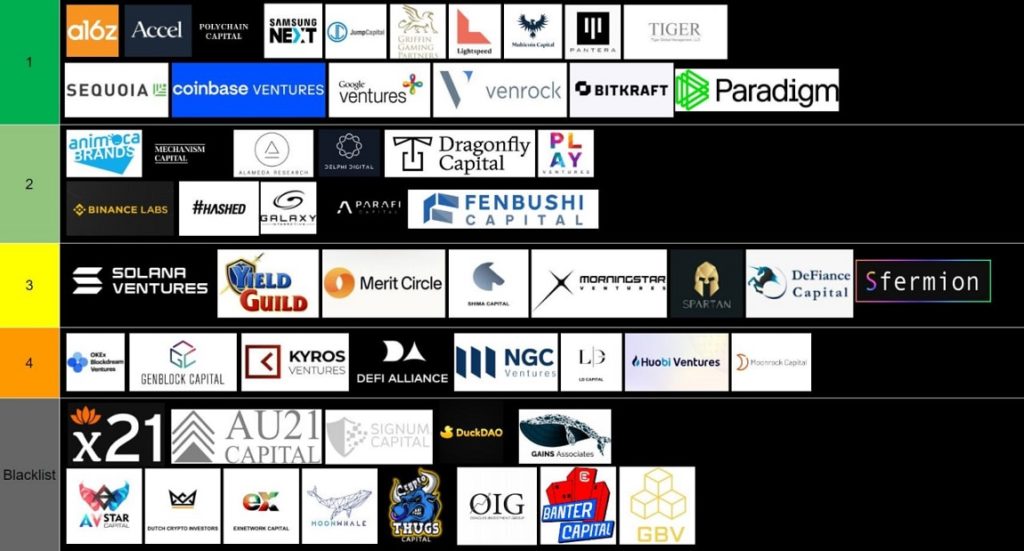

In general, and the whole catch the tier list. It will be useful for beginners. As an option, you can check with yours, if any. Over the past month, the situation has changed a bit and some companies have changed their positions. We do not forget to keep the list up to date and add new ventures.

The list is formed by the quality of projects in the portfolio of these ventures, by the fate of projects, reputation, known public cases and reliability in the subjective opinion of CGP. Some have many P2E projects, some have only a few infrastructure ones.

And also a personal recommendation to study some insights and reports on VC sites, you can find social networks of researchers working in this fund in them in order to follow their publications in social networks. By bringing your information field closer to them, you will be able to better formulate your investment ideas and understand trends. Learn from the best.

Subscribe to our telegram channel and go to our main chat to discuss the latest news.