Lawyer at web3 Inal Tomaev. The author of the @legalweb3 channel has prepared an interesting article for our community-based content section, which touches on a wide range of legal issues for the NFT industry.

Join our Telegram channel and chat to keep abreast of the main crypto gaming trends.

The purpose of this article is to highlight a wide range of legal questions (both asked and not asked) about the NFT industry.

The content of the article:

1. History of origin

2. NFT utility

3. Legal status

4. Copyright

5. Licenses

6. Dispute Resolution

7. findings

A reference to “law” without specifying a specific jurisdiction means the Anglo-American system of law.

History of occurrence

By NFT as a technology (non-fungible tokens, non-fungible tokens), one should mean cryptographic tokens (digital certificate) in the blockchain registry, confirming ownership of almost anything in the digital world (from images to real estate). Each such certificate token is unique and has its own value due to its association with a digital asset.

The first mention of NFT as a prototype should be considered the article by Meni Rosenfeld dated December 4, 2012 "Overview of Colored Coins". The idea of "colored coins" was to describe a class of methods for representing and managing real assets on the blockchain in order to prove the ownership of these assets, i.e. everything is similar to bitcoin, but with the added "token" element that defines its use, making unique. The author already then suggested using such tokens not for an abstract purpose within the blockchain, but to connect the latter with applied purposes in the real world.

On May 3, 2014, digital artist Kevin McCoy minted the first known "Quantum" NFT on the Namecoin blockchain. Quantum is a digital representation of a pixelated octagon that hypnotically changes color and pulses like an octopus. This original demonstration of the use of NFT technology became the prototype of the entire direction of digital art.

From a technical point of view, the blockchains available at that time (mainly Bitcoin) were not intended to be used as a database for tokens representing the ownership of assets, so the active development of NFT began with the advent of Ethereum.

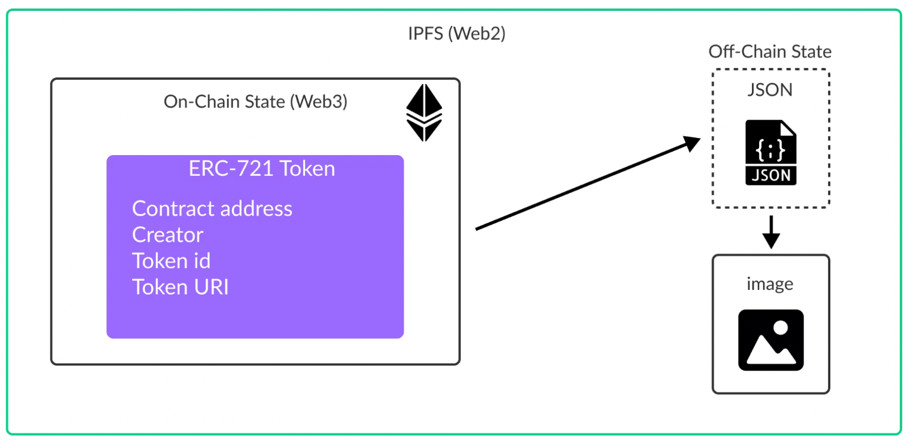

In addition, three options for the existence of NFTs in relation to the main asset should be distinguished:

1. On-chain: all NFT transactions are recorded in one blockchain, which can be easily verified using blockchain explorer. Recent example with the sale of real estate as an NFT demonstrates this well.

2. Off-chain: transactions are recorded not only in the blockchain, but also in another database that is managed centrally. On opensea, we managed to find such an unusual example of a sale tungsten Cuba weighing 907 kg.

3. Legal dependence that connects on-chain with off-chain and is expressed in the right to follow the second after the first and the necessary amount of rights.

Before delving into legal issues, let's try to figure out what assets can be behind NFTs.

Utility of NFT

Due to the peculiarities of the nature of NFTs, they are most widely used in art, where the uniqueness of the work is valued, and their owners automatically become “chosen ones”. At the same time, most ordinary people, hearing about NFTs, immediately associate them with strange colorful pictures that cost millions of dollars for some unknown reason. The trick is that things that may have value in the real world have the same, if not more, value in the digital space.

However, NFT is, of course, wider than crypto art. Rather, they are more correctly treated as a technological tool that opens up new horizons in the virtual and real world.

Below are examples of utilitarian uses of NFTs. Some groups turned out to be quite similar, but with different representatives of this segment. On the other hand, there is definitely more to be added.

Well, actually, art (collectible)

For obvious reasons, traditional works of art, such as paintings, are valuable because they are truly one of a kind - hand painted, in a special technique, often with special paint and so on. Digital files can be easily and endlessly copied, but this is not the case with NFTs. These digital items are bought and sold with a digital certificate proving ownership of a unique virtual or physical asset that someone has produced. In addition, NFT is a new way of classifying digital works of art that allows creators to monetize their work. This is supposed to be a faster process and a more accessible way for designers to create and benefit from work. NFTs can also provide for automated royalty payments to the author on future sales, however, this depends on the platform they are traded on (OpenSea, Rare).

Representatives: art blocks, Murakami Flower Seeds.

PFP

PFP is an acronym for “picture proof” or “profile photo”. At the moment, most common on Twitter, where such a PFP is tied to a specific account. Twitter verifies the NFT profile photo, and if it's correct, the user gets a hexagonal outline. It also allows users to become members of communities, and PFP owners can also get access to games or other products that the community decides to create.

Representatives: BAIC, Cryptopunks.

virtual earth

The NFT here is a user-owned area of the digital earth on the Metaverse platform. The owner has the opportunity to use NFT for advertising, communication, games, work, rent, and so on.

Representatives: The Sandbox, NFT Worlds.

Games

Almost all in-game objects can exist as NFTs: avatars, weapons, animals, lands, and so on.Representatives: list of the best NFT games 2022

Membership

NFT allows you to address user privacy and data processing issues. With their help, you do not need to remember passwords for different platforms. Such NFTs can be resold on the secondary market for profit.

Representatives: Proof, premint

NFT community

Owning an NFT here provides certain advantages when participating in online and offline social events.

Representatives: Vee Friends

Music

Here, the token-content bundle is clearly delineated into “the right to the token” and “the right from the token”, and in most cases the buyer acquires the token itself, and hence the right to sell, transfer or otherwise dispose of this token. But any other rights to use the intellectual property rights that are tied to the token remain with the owners/authors, the token holder can only claim a part of the royalties from streaming as a co-investor.

Representatives: Royal, Rocki, Sound

Brand

The NFT boom has made brands look to NFTs for their potential as digital assets and web3 presence.

Representatives: Adidas, Nike (bought out one of the most famous NFT studios - RTFKT).

Account/account/domain name

In web2, the traditional account/account/domain name does not belong to the user in the full sense of the word. For example, Twitter owns all account information and has the right to revoke or delete accounts. If NFT is introduced into this segment, then a decentralized system of accounts (database) based on the blockchain is obtained, each of which is confirmed by a digital certificate.

Representatives: ENS, Unstoppable.

In addition, there are whole areas where NFT, due to the specifics of its nature, can be very useful:

Such a universal ID in the field of digital services and data storages (voting, attendance at work and classes, medical histories, certificates and diplomas, etc.) can be used as a user identifier and even used in the event that an anonymous court is presented claim.

Legal status of NFTs

From the point of view of law, NFT is a complex object and can carry a different nature, depending on which certain state regulation will be included for specific legal relations (taxes, licenses, compliance with additional requirements, etc.).

Below is an overview of the leading jurisdictions' positions regarding the legal status of NFTs.

United Kingdom

There are no specific regulations in the UK regarding NFTs, which are treated as a type of crypto assets. The Financial Conduct Authority distinguishes between three types of tokens:

Security paper

Provides the rights and obligations specified in investments, which include shares, deposits, insurance. Subject to the Financial Services and Markets Act 2000.

Electronic money

Electronically stored monetary value. They are subject to the Money Laundering Regulations.

However, the vast majority of NFTs do not fall under the above criteria and will therefore unregulated.

European Union

Like the UK, there is no specific regulation or legal definition of NFTs in the EU and there is no harmonized regulatory regime across all member states. The European Commission has published the Crypto Asset Markets Regulation (MiCA), which excludes NFTs from its scope. However, the proposed regulation should explicitly apply if the NFT grants the holder or specific rights, such as rights to financial instruments, such as rights to profit or other benefits. In these cases, the NFT may be treated as a security. NFTs will also be subject to any national legislation within the EU.

China

Cryptocurrencies are banned in China. As for NFTs, individuals can make transactions with them. At present, there are no specific laws or regulations governing NFTs, but on April 13, 2022, the National Internet Finance Association of China, the China Securities Association, and the China Banking Association jointly launched an initiative to prevent financial risks associated with NFTs (“Initiative” ). Although this Initiative is not a regulation under PRC law, it reflects public attitudes in general.

The Initiative does not treat NFTs as cryptocurrencies or virtual currencies. However, keep in mind the following:

- Do not include securities, insurance, credit, precious metals and other financial assets as NFTs;

- Do not weaken the non-fungible characteristics of the NFT by separating ownership or otherwise;

- Do not carry out centralized transactions;

- Do not use virtual currencies such as Bitcoin, Ethereum and USDT as pricing and settlement tools for issuing and trading NFTs;

- Authenticate by the real name of persons issuing, selling and buying, and properly maintain customer identification information and NFT issuance and trading records, and actively cooperate in anti-money laundering work; and

- Do not invest directly or indirectly in NFTs or provide financial support for NFT investments.

United Arab Emirates

The regulation of NFTs and crypto assets occurs mainly at the level of free economic zones (free-zones). For example, the Abu Dhabi Free Economic Zone (ADGM) recently published a consultation paper titled “Proposals for Improving Capital Markets and Virtual Assets”. In its proposals, ADGM believes that companies will need a license from the free zone financial regulator to be able to trade NFTs. It is also believed that NFTs may lead to compliance with the ADGM Anti-Money Laundering and Sanctions Regulations. Although this is still only in the form of consultations, market participants should consider these obligations.

The Dubai Free Economic Zone (DMCC) has introduced the licensing of NFT marketplaces.

NFTs may, under certain circumstances, be subject to another regulatory document, the “Crypto Asset Rules”. These rules apply to crypto assets that are securities or traded on an exchange. Depending on the nature of the underlying asset, anti-money laundering requirements may be involved.

Singapore

The Central Bank of Singapore recently announced that it will not regulate the NFT market. He believes that the emerging market is in its infancy and is currently unwilling to regulate what people put their money into.

However, under Singapore law, if an NFT has the characteristics of a capital markets product under the Securities and Futures Act (SFA), it will be subject to the regulatory requirements of the MAS. For example, if an NFT structure were to represent rights to a portfolio of listed shares, it would, like other collective investment schemes, be subject to prospectus, licensing and business conduct requirements.

Similarly, if an NFT has the characteristics of a digital payment token under the Payment Services Act (PSA), this may impose special restrictions and obligations on the seller of such NFT.

USA

Currently, there is no clear regulation of NFTs in the US, they should be considered as crypto assets. The Responsible Financial Innovation Act (RFIA) bill is being considered, which will create the first comprehensive regulatory framework for digital assets in the United States. The draft law refers most digital currencies to commodities, which means that they will be regulated by the Commodity Futures Trading Commission (CFTC). The RFIA offers a clear standard for determining when digital assets will be considered commodities and when they will be considered securities. Until then, the nature of NFT as an object of regulation is determined by the Securities and Exchange Commission (SEC), which applies the Howey test for this. The current approach to regulating all crypto assets, which includes NFTs, reflected the comment of SEC Chairman Gary Gensler “…securities laws should cover crypto assets.”

In general, the approach of these jurisdictions is similar: we do not yet fully know what NFT is, but if it looks like an object of regulation (commodity, currency, security), then we will not think twice. In addition, there is currently a serious trend towards tightening the regulation of crypto assets and NFTs, in particular. The United States is expected to be the locomotive of this activity.

Авторское право

Spoiler alert!

Ownership of an NFT does not automatically mean the acquisition of copyright in the object behind the NFT.

United States copyright law protects “original works of authorship fixed in any tangible medium”, which (copyright) automatically passes to the author as soon as the original creative expression is fixed by the author in a tangible form. This means that any creative creator automatically obtains legal copyright for their work without having to do anything else (no registration required) simply by virtue of expressing that work in a tangible form.

Eight categories of protected works are recognized: (i) literary works; (ii) musical works; (iii) dramatic works; (iv) pantomime and choreographic works; (v) graphic and sculptural works; (vi) motion pictures and other audiovisual works; (vii) sound recordings; and (viii) architectural works. Images associated with the NFT are copyrighted in accordance with paragraph (v) - figurative and graphic works.

Copyright protection grants the copyright holder the right to (1) reproduce, (2) distribute, (3) publicly display and (4) perform the work and (5) create derivative works, and perhaps most importantly, (6) grant the copyright holder the right to prohibit others do any of the above.

One of the benefits of buying an NFT is that all authentication is done on the blockchain. If you buy a work by a well-known NFT artist, then the authenticity of the NFT will be confirmed by the fact that the seller's original account is associated with the artist (it is up to the marketplace to verify this), and you know for sure that the purchased NFT is genuine, no matter how many times it is resold (everything can be tracked in the blockchain explorer). However, what you won't know from the blockchain is whether the purchased NFT was a copyrighted copy of another artist's work.

According to section 504 Copyright Actsale of an infringing work, even if done without intent, automatically makes the seller liable for actual damages and/or statutory damages between $750 and $30 per infringement. If this violation is recognized as intentional, the amount will increase to $ 000 per violation (yes, just for the violation, that is, how many NFTs, so many violations).

We also note the complexity of interpreting the moment with the transfer of rights through NFT. If NFT and copyright are different objects, then the transition to them can be done in different ways. In this context, it is interesting to look at the Terms & Conditions of one of Bored Apes Yacht Club's most successful collections, which states that “when you purchase an NFT, you have full ownership of the underlying artwork”, literally “when you purchase an NFT, you own the underlying Bored Ape, the Art, completely.”

One interesting detail is seen here: the possibility of separating the NFT as an independent object and the rights that stand behind it. In practice, it may turn out that the owner of the Bored Ape NFT (who owns both the token and the work of art) decides to transfer, say, the rights to the image for the design of t-shirts to person A, and sell the NFT itself to person B. Under the Bored Ape Rules, the transfer of NFT means the transfer all the rights behind him, and person B did not transfer the rights to the image for the design of t-shirts to person A, that is, the latter will be the infringer. Another interpretation is also possible: person B is not related to the transaction between the owner and person A, therefore there is no violation. At the same time, there will also be no violation if either B also starts making T-shirts with the same Bored Ape NFT image. It seems that such conflicts could be resolved by analogy with the right in rem, when the encumbrance follows the thing. In this case, the rights to the NFT and the rights from the NFT will be inseparable (I found only one project with this format, this world of women, and the agreement is subject to French law). And it seems to solve our problem, but not completely.

According to subsection (a) of section 204 of the Copyright Act “A transfer of copyright, except by operation of law, is void unless the transfer document is in writing and signed by the owner of the transferred rights or a duly authorized agent of such owner.” Of course, we are not talking about the paper version and options with “check the box if you agree” are accepted. However, this will work for the initial purchase, when the owner in the example above made the first transaction. Further in the chain, no one ticked the box, let alone signed any documents. And this is a completely different topic. If anyone is interested, here is a good article About the connection between smart contracts and legal contracts. That is, the logic is as follows:

- The owner of the NFT is also the owner of the content behind the NFT;

- The owner of the NFT alienates the NFT under a smart contract, and this does not affect the fate of the content behind the NFT, unless it is explicitly stated

- Moreover, according to the meaning of the law, a separate document on the transfer of rights is needed; and

- This document must be signed by the copyright holder.

One of the key aspects in matters of authorship is the understanding of what is a derivative of the author's material (derivative). In general, derivatives, in my subjective opinion, are in some ways even more valuable than the original. Let me explain: the true value of the original can often be understood by the number of derivative works, that is, the uniqueness of a truly new author's approach can be “measured” through the network effect due to the number of derivative works (virality).

From a legal point of view, a derivative is a work based on one or more pre-existing works. Possible examples are translation, musical arrangement, dramatization, film version, sound recording, artistic reproduction, reduction, or any other form of processing, transformation or adaptation. At the same time, the copyright for the derivative extends only to the part that was contributed by the author of the derivative, which distinguishes it from the pre-existing material, and does not imply any exclusive right to the pre-existing material.

Key criteria for recognizing a work as a derivative work:

1. Originality

New material must be original and copyrighted in and of itself. This requirement is justified by several precedents when it comes to copying a derivative. The court in such cases could not defend the author of the derivative, since he copied the original work almost completely.

2. Legality

Everything is clear here. In any case where a copyrighted work is used without the permission of the copyright owner, copyright protection does not extend to any part of the work in which such material has been used unlawfully. If you want to make a derivative and make money on it, ask the author.

Again, there may be additional criteria, I have indicated those that I consider key.

So, it was the ability to create derivatives, according to many experts, that led to the incredible success of the Bored Apes Yacht Club collection, because the Bored Apes Rules allow unlimited commercial use of purchased NFTs. Specifically, it provides “an unrestricted, worldwide license to use, copy, and display purchased artwork for the purpose of creating derivative works of the artwork, including for commercial purposes.” And there is a contradiction here, because in the same Rules (a little higher in the text) it is already said that “when you buy an NFT, you fully own the Bored Ape art object that underlies it,” and it turns out that there is nothing to transfer for commercial use. Here, most likely, they wanted to emphasize the right to derivatives separately, they just didn’t do it very well.

As you can see, copyright law will treat NFTs the same as any other traditional work of art, because copyright takes precedence over blockchain in this matter. If an artist creates a new work of art, he automatically acquires the copyright for this new work of art, as well as a number of exclusive rights. Thus, copyright includes those rights that cannot be transferred (the right of authorship; the right to an author's name; the right to the inviolability of a work) and those that can become the subject of a contract due to their commercial purpose (reproduce, distribute, create derivatives, etc.) . The main rights to reproduce, create derivative works or distribute copies of the work remain with the author, unless otherwise indicated and he did not transfer them. A key factor in concluding a deal will be the exact determination of the amount of rights transferred along with the NFT.

To show how certain actions are now being recognized as infringing copyrights, let's turn to public cases.

Benjamin Ahmed and "Strange Whales"

A 12-year-old programmer named Benyamin Ahmed started his own NFT project. 3350 computer-generated "Weird Whales" sold for almost £300. It was soon discovered that the graphics for the project had been directly copied from another project, using a four-year-old pixelated image as the basis for all of the Strange Whales images. The original author did not declare himself.

In November 2021, director Quentin Tarantino announced that he would be selling seven NFTs related to the 1994 cult film Pulp Fiction. Each NFT, according to Tarantino, will include "uncut first handwritten scripts" from the film with "exclusive individual commentary" by the director. Miramax, the film's distributor, has filed a lawsuit against Tarantino. Arguments: Defendant does not have legal rights to create and sell NFTs and misleads consumers about the creation of NFTs by Miramax. The case is currently under litigation.

In January 2022, French fashion house Hermès filed a lawsuit against California artist Mason Rothschild. In December 2021, Rothschild announced his NFT project “MetaBirkin”, featuring Hermès Birkin bags and the company’s trademark. Arguments: Rothschild misappropriated the Hermès Birkin trademark and also profited from the sale of over 100 digital collectibles. The case is currently under litigation.

In February 2022, Nike filed a lawsuit against online sneaker retailer StockX for selling its “Vault” NFTs without permission. Arguments: StockX deliberately and knowingly used Nike's trademarks without permission to create an NFT is misleading consumers about Nike's likely creation of an NFT. The case is currently under litigation.

In this case, there is no dispute, just the guys hit the media headlines 2 times. The first time, when they bought for $3.5 million a copy of an unpublished manuscript of the script for Alejandro Jodorowsky's film "Dune" to create an NFT based on it and burn the original (what kind of fashion?!), and the second time, when they admitted that they did not know that the acquisition of the manuscript does not mean the acquisition of rights to it :)

Perhaps the most high-profile case that excited the entire web3 community. In July 2021, the largest NFT marketplace, OpenSea, removed the CryptoPhunk collection from its NFT site in accordance with the received “Notice and Take Down” notification under the DMCA (U.S. Digital Millennium Copyright Act) from Larva Labs, the original creator of the CryptoPunks collection. Both collections were pixelated images of punks, but in the case of Cryptophunk, the punks were looking left, not right.

Hit Piece and everything, everything, everything

Well, the cherry on the cake. In early February 2022, several musicians found their work crushed on the set Hit Piece and they were very surprised, because none of them gave permission for this. For weeks, HitPiece has been attacked by hundreds of outraged musicians demanding the removal of NFTs based on their work. At one point, HitPiece sold NFTs with content from Disney, Nintendo, and John Lennon. As far as I could find out, nothing came to court, the developers deleted the original site, made a new one, and now they work on the old domain and sell some kind of nonsense (I'm very subjective).

The task of combating copyright infringement is trying to solve the largest online gallery deviantART through NFT image recognition on marketplaces and smart contract analysis.

The task in the same area is being solved by a Californian startup Optic (using image recognition technology and machine learning), which works closely with the largest NFT marketplace OpenSea.

Licenses

We have already noted that the creator of a creative work (author), whether it be art, music, literature, etc., has both inalienable copyright and exclusive (exclusive) and has the legal right to decide how this work can be used by others in the future .

Participants in the process of creating an NFT (take a collection of PFPs as an example) can be the following persons:

- Project owner. Concept author, producer, founder, ideologist. The one who started everything and brought everyone together.

- creator/creator. A creative person who realizes his plans, that is, draws, develops a concept, invents, invents, creates. Such people can be creators or hired specialists.

- Investor. NFT Buyer.

- Community. Usually this is everyone who is involved in the project, starting from the owner and ending with social subscribers. networks. This may include creators, authors who create derivatives, sponsors, promoters with their own interest (shillers), influencers and God knows who else, aimed not only at making money, but also at their free contribution to the difficult task of developing the project.

- Marketplace. NFT trading platform.

Of course, it is possible to create an NFT alone, but let's consider such an extended version to understand the transfer of rights, likely scenarios for changing their volume and the sources of the main legal disputes and holivars: is it possible to make derivatives? what about parodies? what about merch? What if it's not for resale? and pay royalties? Well, you understand.

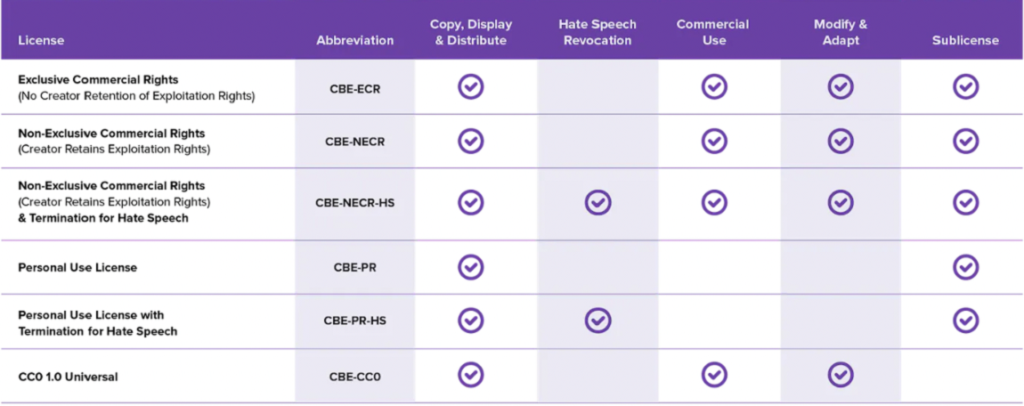

NFT market participants themselves understand that they need clear rules for regulating intellectual property rights and offer their own options.

In 2018 year Dapper labs (cryptokitties, NBA topshop) offered their NFT license. This is the earliest example of such a license that I have found.

And already in August 2022, the a16z venture fund offered the market its vision of possible NFT licenses.

A little earlier, at the beginning of the summer of 2022, there was a massive use of conditions Creative Commons License when selling NFTs. And the same a16z wrote a big Article about why NFT creators choose the CC0 tool (creative commons has several license variations) to transfer rights.

By accepting the CC0 license, the copyright holder effectively agrees to waive their copyright and related rights in the copyrighted works to the fullest extent permitted by law. As a result, the work is effectively “dedicated” to the public domain. If for any reason the waiver of these rights cannot be enforced, then CC0 essentially becomes a license granting the public an unconditional, irrevocable, non-exclusive, royalty-free right to use the work for any (!) purposes.

Thus, owners of NFTs regulated under CC0 have no restrictions on commercializing NFTs or using them in any way they see fit, they even become equals with NFT project creators when it comes to owning an NFT collection.

But at the same time, since no one owns the work of art, this means that anyone (even someone who does not own NFTs) can use the work of art for any purpose, including creating NFTs. This is where the logic breaks down, because why waste resources on creating NFTs if you can't prevent individuals, even those who don't own your NFTs, from using the art associated with your NFTs. The answer can only be that you are promoting the NFT ideology and you are not doing it for profit reasons.

So, in fact, there are not so many main ways of fixing the amount of transferred rights, they can be grouped as follows:

The buyer does not receive any rights other than the right to display NFT

The buyer receives strictly limited commercial rights in respect of the NFT held by

The buyer receives all the commercial rights in relation to the NFT, which he owns

The copyright holder is effectively obligated to waive his exclusive rights to copyrighted works to the fullest extent permitted by law.

Another problem with NFT license agreements (apart from determining the scope of rights transferred) is the asymmetric control that the copyright owner has over the license. Copyright holders have the right to modify and revoke the NFT license from NFT holders at their sole discretion if they believe the license agreement has been violated, or for any other reason, or no reason at all.

This ability to change the license agreement at any time can be a major deterrent to the entire NFT industry, as the rights of each NFT owner can be unilaterally restricted or completely revoked. And many license agreements provide that there is no obligation to notify NFT owners of changes or additions to the license.

Given the variability of options for defining rights limits from NFT, I would suggest that NFT creators think about the current and potential problems of the industry and their project in the field of rights transfer and discuss them with members of their community in the best traditions of web3, because in this industry it is the community that rules, and only then formally fix how exactly the licensing will work in relation to NFTs and, of course, exclude the possibility of changing the terms of license agreements unilaterally.

Dispute resolution

The NFT industry is too young to analyze court precedents. However, as we understand, the rules of law on the protection of intellectual property can (and should) be applied in the event of disputes about authorship and the use of someone else's intellectual work when creating an NFT.

What questions might be of interest to the court?

- Is there a fact of using someone else's intellectual property?

- Has the authorship of the person who claims infringement of his copyright been proven?

- Is there any damage?

- What were the goals of the perpetrator?

- What actions did he take to violate and what did they lead to for him?

There may be even more questions, but these are enough in our case to understand the logic of the court. Answers to questions will help to delimit the guilty actions of the offender for the purpose of making a profit from others, in which the so-called judge will also help. The “fair use doctrine” created by Anglo-American law in the 18th and 19th centuries (“Fair use doctrine”), which is designed to allow the use of other people's copyrighted materials without the permission of the author in limited cases.

The doctrine consists of 4 criteria that the court needs to find out:

Purpose and nature of use

The court needs to understand whether such use is commercial or for non-commercial educational purposes. To justify a use as "fair" one must demonstrate how it advances knowledge or progress in the art by adding something new. This “new” is interpreted by the courts as “transformative”.

The nature of copyrighted materials

To prevent private ownership of a work that rightfully belongs to the public domain, the court needs to understand the source of the idea. In this regard, already known facts and ideas are not subject to copyright protection - only their specific expression (description, methodology, scheme, etc.), in such a rethinking of known information, authorship will be expressed.

Scope and Materiality

These two sub-criteria must be considered together. First, the court establishes the amount of information that is considered disputable (in the number of characters of text, pieces of a photograph, part of an image in a photograph, etc.) and compares it with the original whole work. In this context, the less used in relation to the whole, the more likely the use will be considered fair. Next, the court needs to determine the materiality of the disputed part of the information in relation to the original whole, and often the second subcriterion outweighs the first in legal significance and the volume fades into the background.

The effect of the breach

A use that harms the copyright owner's ability to benefit from the original work and replaces the demand for that work is not considered fair.

The courts can also supplement the doctrine with their own criteria, which are designed to clarify and add greater clarity to the disputed situation.

If we rethink the controversial situation between CryptoPunk and CryptoPhunk, then it is the doctrine of fair use that would underlie the decision of the court. In general, it would be interesting to read the court's decision, but since OpenSea decided everything on its own, we'll try to put ourselves in the place of the court.

In his open letter, the anonymous infringing author explicitly states the purpose of creating his collection as "parody and satire" (this is the first criterion of the doctrine - "Purpose and nature of use"), however, if other criteria are taken into account, it turns out that he:

- Insufficiently implemented the principle of “transformativity” (the first criterion);

- Used materials that were already in the public domain (second criterion);

- The volume of original ideas used is high and significant (the same style and concept, the only difference is that the punks look the other way) - the third criterion;

- The effect of the violation is significant (both collections were traded on OpenSea and the probability of buying the wrong punk from buyers was high, which affected the reputation and income of the author, which means that the original goal was probably still commercial) - the first + fourth criterion;

- Well, the anonymous person knew about the author of the original materials (this criterion can be used as an additional one).

So OpenSea's solution seems to make perfect sense.

Conclusions

The entire past and current years are NFT time. Despite the principles of openness, the industry needs the rules of the game. Players who have come to the NFT industry seriously and for a long time will quickly adapt, because they understand that the rules are designed to protect them, and not just users.

Understanding for NFT creators the legal status of their future digital assets, how they can be transferred and the scope of the rights contained in them will allow us all to build a more reliable industry.

And finally: with the development of the industry, the number of controversial situations will increase. Potential contentious situations in NFT:

- Royalty payments

- Disputes over the scope of transferred rights under the license

- NFT theft

- Counterfeit (similarity to the point of confusion)

- Taxes

- Advertising and promotion

- Hacker attacks

- Personal Information

- Intruder identification

- Conclusion of transactions with collateral under NFT

- Responsibility issues of NFT marketplaces

Subscribe to our telegram channel and go to our main chat to discuss the latest news.