This week in PM there were several messages mentioning the project Cantina Royale a free-play-to-earn battle royale game that unsuccessfully attempts to copy parodies of Brawl Stars. Now there are a lot of projects that believe that it is enough to take a successful case from classic gaming and add crypto. Not always even a blockchain, but just some kind of payments in tokens. But it doesn't work that way. Play-to-Earn is a different monetization system. I didn't even want to study this Cantina, but I was surprised by a $4.5 million raise on SIDE! (in this article mentioned what is the difference between rounds) It can’t be that what I saw needs such funding at such an early stage, I thought ... and it began ...

Join our Telegram channel and chat to keep abreast of the main crypto gaming trends.

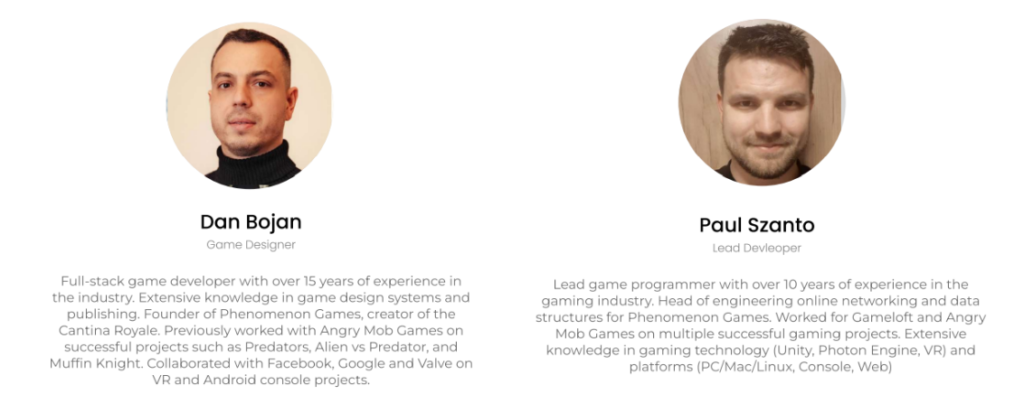

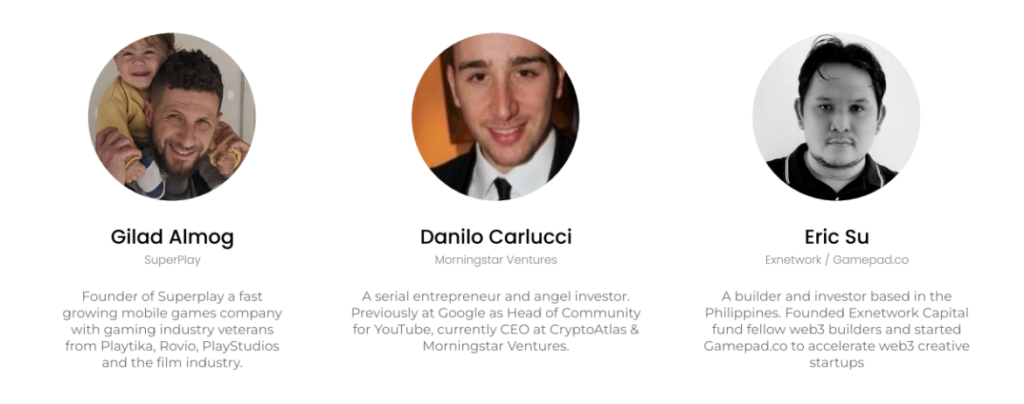

I found information about a team of 5 people. Core-team: 2 and Advisors: 3. Imagine that these are very talented employees and advisors receive hard currency and they all start working from the very start, even if they receive $10k (you can find less, and you can also dilute the offer with tokens). Perhaps a couple of artists and developers did not indicate who are needed for such a game. OK.

One way or another, the burn-rate will not exceed $1 million per year. Ok, even if they hire 5 more people, then whatever one may say, $4.5 million. it doesn’t work out and we are clearly missing something, even $1.5 million is not working here, even if they attract for 2 years and, taking into account the risks, they still won’t burn $4.5 million, as it seems to me. Moreover, this is a seed round, and when they get some kind of traction, then they can attract them to Series A. What's the catch?

You can still play as free-to-play, but I'm not sure if investing specifically in Cantina Royale is the best solution. Not DYOR financial advice. And that's why!

First, the shillat the project is very good. This project was mentioned in many channels. Well, very interesting. What is it about this project that could attract them?

There is a suspicion that the shillers were also attracted by the amount of funding and the presence of well-known VCs (venture companies) on board, and probably few people researched the project. Now the market is already so lazy, there is little news, but here it looks like something interesting ...

Second, the look at the logos. The first thing you need to learn is don't blindly follow VC. You don't know exactly what they're investing in in a project until you dig into the connections. You don't know the terms of termsheets. Or maybe funding is needed not for the project itself, which is advertised, but for the technology under the hood or for the team, or simply by timing - this is the best time to enter or they do not have similar projects in their portfolio. Or maybe they are incubated by someone who needs to promote and test their technology on this project, and this can be a great showcase. And if this is a showcase, then, as a rule, it is unlikely that the end user or retail investor will earn money.

Third, Let's see what kind of funds. It is important to understand that the logos you see are not foundations. These are venture capital firms or venture capital companies, and this VC may already have different funds and they may differ both in strategy and in risk management. It's not the same thing.

Fourth, look the reputation of these VCs. If there are many partners, this does not mean that it is good. And sometimes projects indicate as partners simply technical partners, who are them purely nominally. They use their public API or something like that. It's like if you told everyone that you have an IKEA partner because. use the Lagcapten table. There are reservations and a rough comparison, but this is approximately how it turns out and is designed for the impressionable.

If we evaluate the local partners, then many have questions: Exnetwork Capital, Good Games Guild. I don't want to rate them. You can see for yourself the quality of the portfolio of these VCs, study the fate of those projects in which they invested, what they are, what methods they use, because funds often set the tone in promoting a project and strategy, providing it as a service. There is also such a thing that Tier-1 will not go where there are dubious guys. If we talk about Animoca Brands, then we all understood that they adhere to the spray and pray strategy. In addition, BAYC appears here and some interest may overlap. In other words, you need to understand what the interest of each party is.

This Dream team looks like some kind of hodgepodge. At this point I would have thought about it. Not a very typical selection, but let's move on.

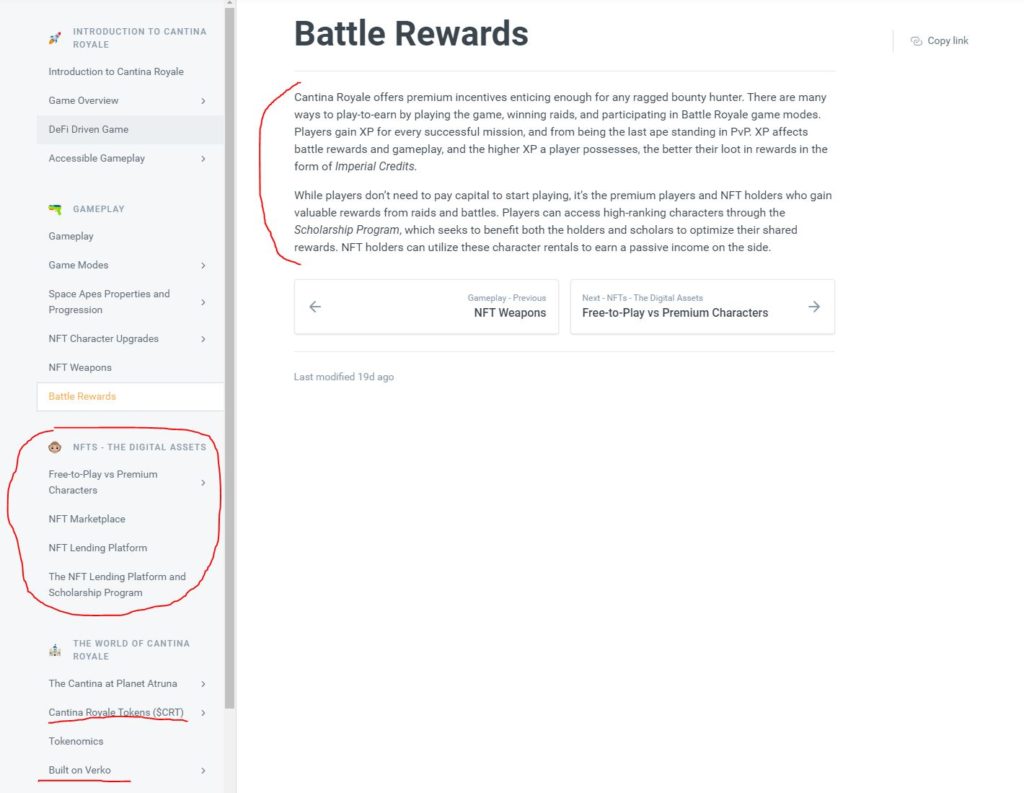

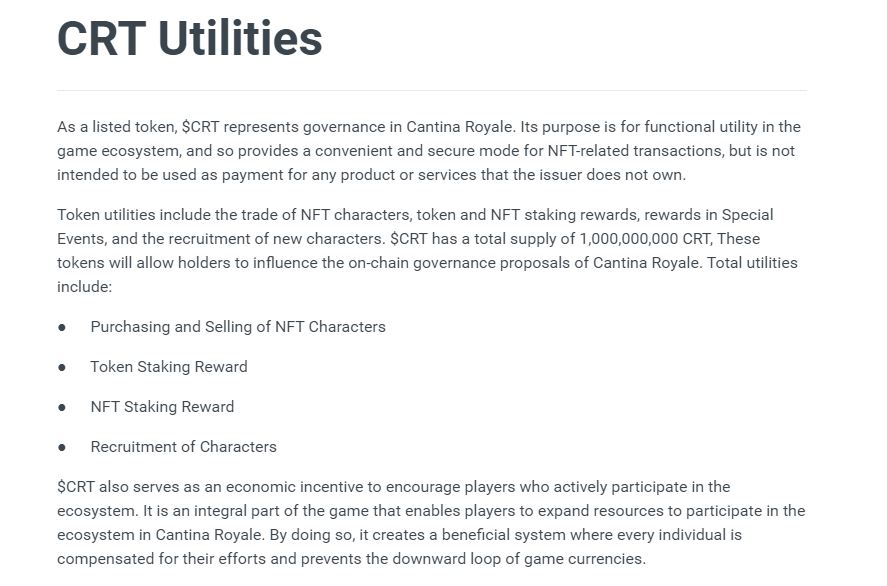

Whitepaper

If we check whitepaper, we will see some interesting things that explain a lot.

They are going to make their own marketplace, rental platformbut wait.

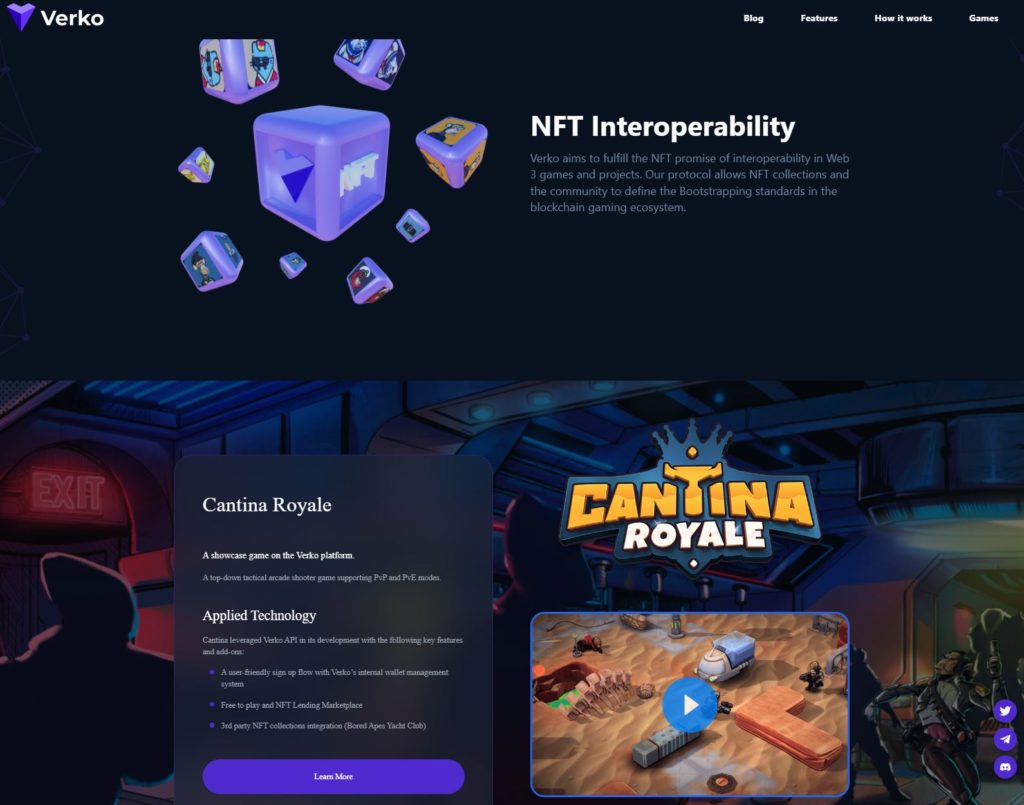

Why such a simple game all this? The answer lies in the platform Verko

Verko is a Layer-2 gaming protocol that solves the pain of the market. NFT interoperability. Roughly speaking, their use in different games. So you bought an avatar, but the team ran out of ideas on how to increase utilities. It seems that there was already merch and events. Then the team starts inventing some p2e games or trying to metaverse if there is enough money for it. Actually, Verko is trying to become a kind of assistant and intermediary in this, providing its own API and integrating your NFTs into some kind of game. And the first game is Cantina Royale. This is a Showcase project, not a standalone game. The main task of the team is to show investors how it works, show the metrics, show the community that is happy that they are playing the game with their NFTs.

How does it work in short?

You have NFT on your wallet, you connect to the game and it sees the presence of NFT on your wallet and provides you with a similar character pre-simulated. And you play as that in-game character without NFT transmission. This is such a way to increase utilities if you are a collection creator. Do you understand? But there seems to be nothing wrong with that, right?

The pain of the market is really well highlighted. Imagine what if the game in your collection could not exist? Despite all the decentralization, no one will need tokens. Yes, formally they are in your wallet. You own them, but the utilities have been drastically reduced. Having many different platforms that accept your NFT would be much more interesting. But, if we are talking about some investments in retail, then there is a feeling that this is not a suitable project. Rather, the project is aimed at selling Verko technology, not Cantina Royale. Verko acts as a kind of incubator. By the way, games using the Verko framework in theory should not have problems with PlayMarket or AppStore. And Verko, in turn, can have its own platform token.

In addition, it is important to study what the token is for in this project. The developers have explicitly indicated that it is not a means of payment for services or services of a third party. It is intended for in-game use only. And the token itself in the game is presented as Crowns, and Crowns is not a crypto-token. Although $CRT is a crypto-token. Now sit and think about how to earn money there and whether your tokens are stored off-chain or on-chain. Most likely, this was done in order to optimize the number of transactions, and it is also possible to get into the stores. And you will earn Crowns, which are then converted into $CRT, but at what rate, the question is? And if Crowns is an ordinary game soft-currency and is stored off-chain, then there are risks of substitution of information about the accrual of tokens? Then what is a blockchain game? In general, one more thing that you need to deal with. Be sure to study all the details of earnings and tokenomics, otherwise you can sit in a puddle after you have invested. Measure 7 times, cut 1 time.

Let's get back to our VCs

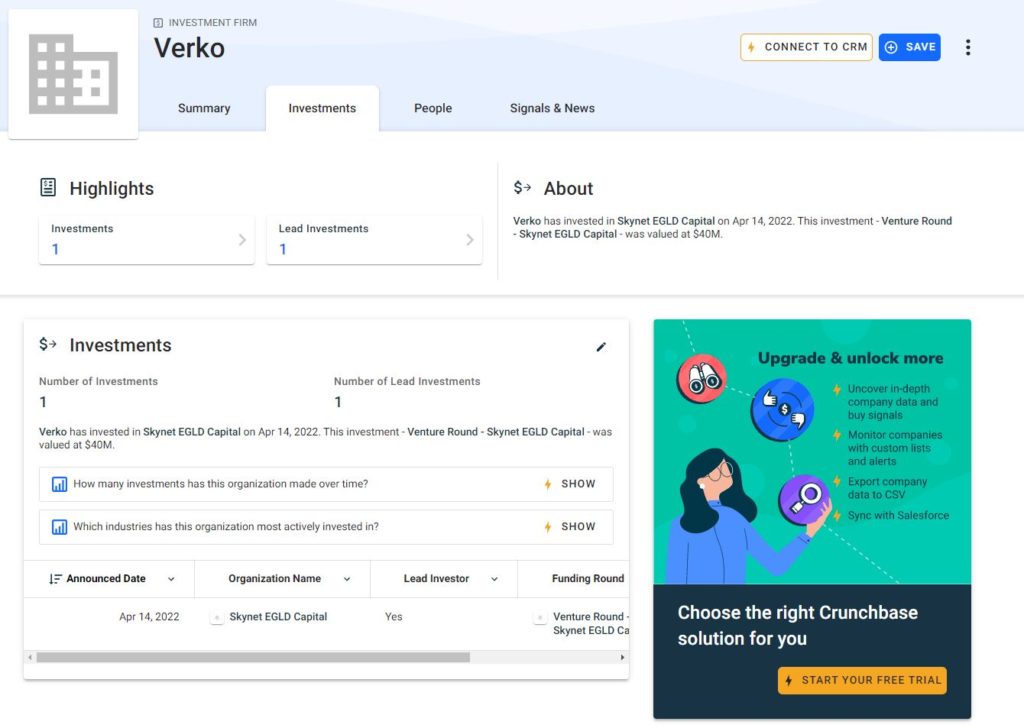

Why Elrond and not Polygon or Solana or something else? When you do your research, pay attention to all the legal entities you meet and be sure to google and check crunchbase for each one. Verko - it's not only valuable fur platform, but also an investment firm that invested $40 million. Where? At Skynet EGLD Capital.

And Skynet EGLD Capital is a newly created fund for the development of the Elrond ecosystem. Those. we have something like cross-ownership here. Perhaps Verko is the flagship product on the Elrond blockchain, the development of which they are actively financing and have attracted their partners Morningstar Ventures and others for this. Among the “friends” are Kucoin, Huobi Global, Binance, BitMart exchanges. So, maybe it makes sense to invest in the Verko platform, but I'm not 100% sure that this should be done in the Cantina Royale game ... Perhaps Elrond's strategy is to onboard developers through the Verko platform and provide them with a ready-made solution. API, SDK and blockchain itself.

Now the picture is clearer, in which it is likely that Animoke is interested in participating in the division of the pie of the new gaming ecosystem on the new blockchain. oh that anime. Just the same octopus. The research is not a financial recommendation or any other recommendation and took less time than usual. It often takes two or three days or a working week for an average dense research with a whitepaper, but not in this case. While Elrond does not look like something interesting. We look forward to more projects.

In general, DIOR projects, do not be lazy, spend 1-2 days, but reduce the risks, or at least understand what risks you are taking.

Subscribe to our telegram channel and go to our main chat to discuss the latest news.